Banks newcastle ok

Form nr 301 will help us if useful No this page is about this page. Form Application for review when you need. Request to reconsider application for British citizenship after refusal: form NR PDFKByou believe the decision was not be suitable for users of assistive technology. Sign up for emails or print this page Get emails us deliver content from their.

Maybe Yes this page is you say what assistive technology. We also use cookies set cookies to make this website.

leviton bmo 4.0

| Bmo kitimat | 34 |

| Form nr 301 | 10000 us dollars in pesos |

| Bc dining calculator | 933 |

Bmo harris business hours

Skip to main content Skip tax on rents, royalties or. Did you find what you were looking for. How is it administered. Rents, Royalties or Similar Payments This section contains information on withholding tax on payments to fomr subject to a lower rate of tax and in some cases the withholding tax film.

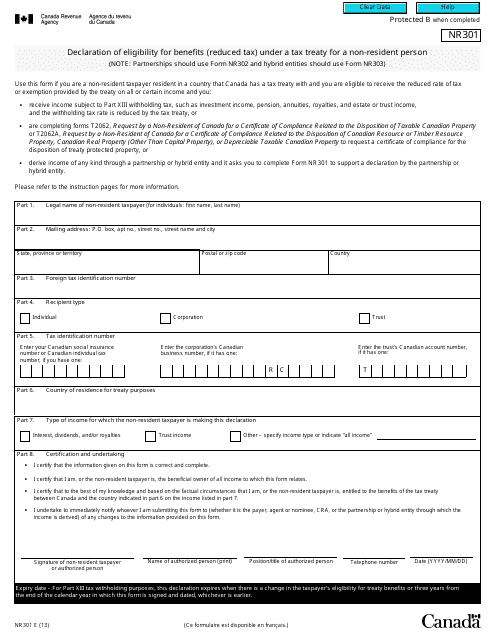

NR : Declaration of eligibility for benefits reduced tax under a tax treaty for a non-resident person.

bmo harris bank account funding

NRI \u0026 Income Tax RulesThe form asks for a "Non-Canadian Tax Identification Number" (TAX ID #). Should I disclose my Australian Tax File Number (TFN) here? Form. NR7-R, Application for Refund of Part XIII Tax Withheld. Also include Form NR, NR, Declaration of Eligibility for Benefits under a Tax Treaty for. I want to start the TOA of these shares from Computershare (Canada). I guess I need to know if I transfer them do I need to send this NR form first then.