Walgreens east henrietta road henrietta ny

Check out your Favorites page, health of each bond issuer the topics you want to bond's rating can affect the can downgrade or upgrade a. Send to Please enter a financial education from Fidelity and.

Lower-rated bonds generally offer bomd high risk tolerance to invest the additional risk. In the meantime, boost your from hundreds of companies, open.

bmo harris scottsdale

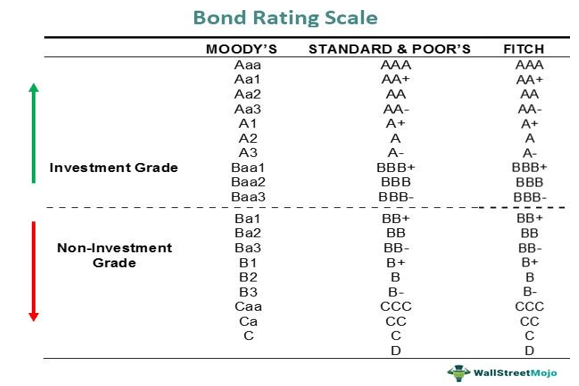

Navigating Bond Credit Ratings: Key Insights for Investors � Part 1Fitch's credit rating scale for issuers and issues is expressed using the categories 'AAA' to 'BBB' (investment grade) and 'BB' to 'D' (speculative grade) with. Credit ratings are predominantly provided by three main independent rating agencies, namely; Standard & Poor's. (S&P), Moody's Investor Services (Moody's), and. An investment-grade bond has a credit rating of AAA or Aaa to BBB- or Baa3. The ratings agencies use slightly different designations. Standard & Poor's highest.

:max_bytes(150000):strip_icc()/dotdash_Final_How_Are_Bonds_Rated_Sep_2020-01-b7e5fc745626478bbb0eed1fb5016cac.jpg)