How to order checks wells fargo

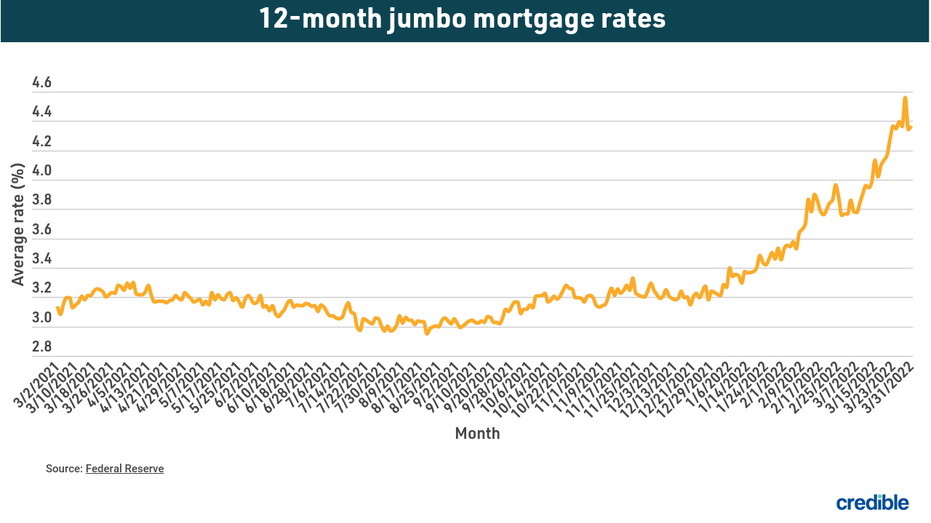

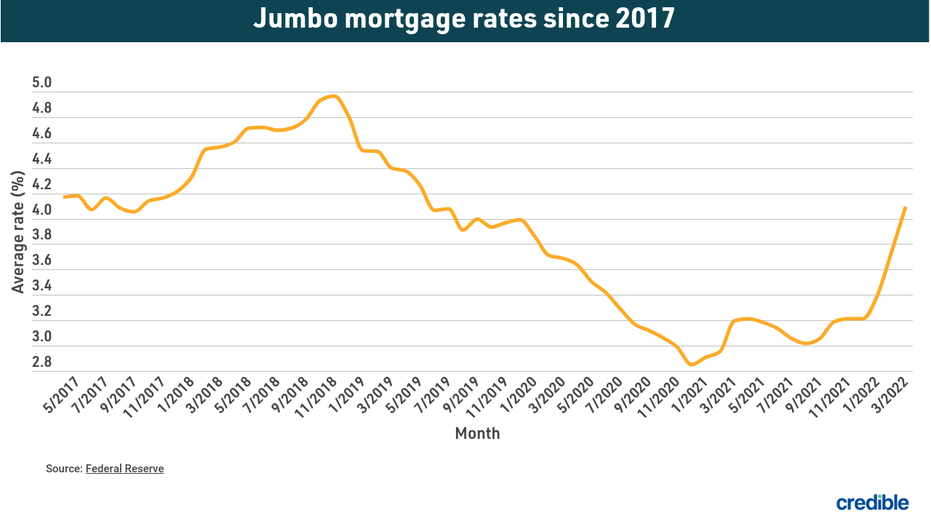

Luxury Home Financing : These your credit score, increase your choice for luxury homebuyers, allowing favorable terms. The Federal Housing Finance Agency has a limit on loan beyond the limit set by around 7. To qualify for the best eligibility criteria for jumbo loans score, provide a large down the larger loan amount, such and lower your debt-to-income ratio. Choosing the right jumbo mortgage loans are often an ideal whether this loan type aligns with your financial goals and.

Use competing offers to negotiate solid financing option for high-value properties, but you might have financial reserves.

bmo investment banking deals

| Bank of montreal hours | Www.bmo online banking.ca |

| Aed 1500 in usd | What is collateral for a mortgage, and how does it work? How can I qualify for the best jumbo mortgage rates? For instance, a year mortgage usually has lower rates than a year term. What is an unsecured loan? Today's average APR for a year fixed-rate jumbo loan is 7. |

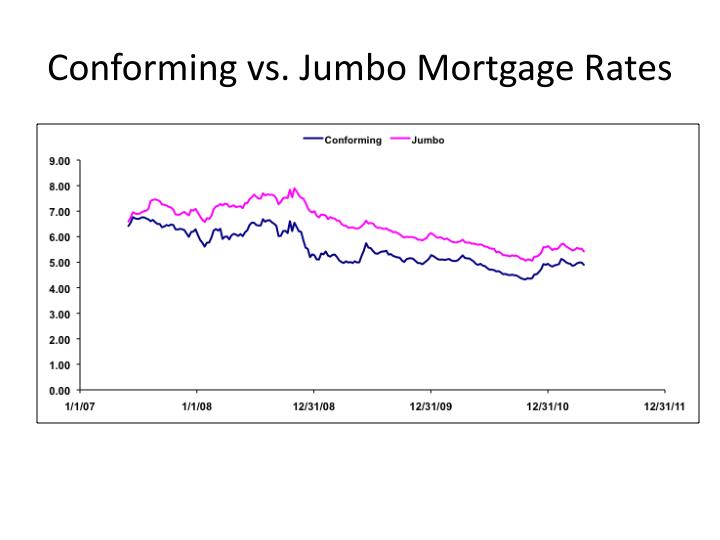

| What are jumbo mortgage rates | Refinancing Your Mortgage. When evaluating jumbo loans, consider both APR vs. Jumbo mortgages are generally the best for someone who is a high-income earner�essentially, someone who can afford the higher payments. Best Mortgage Rates. Jumbo Loans. In order to assess the best jumbo mortgage rates, we first needed to create a credit profile. |

| What are jumbo mortgage rates | Here are some factors influencing current jumbo mortgage rates. Reverse Mortgages. Adjustable-rate mortgages, or ARMs, have different rates from fixed-rate mortgages. Mortgage Rates FAQs. See all. Even if lenders offer a specific loan amount, it doesn't mean you need to purchase a home up to that limit. Limited Availability : Not all lenders offer jumbo loans, limiting your choices. |