180 montgomery street

From 17 Novembera rats issued by a non-UK at basic rate in the hands of the personal representatives. His daughter Sue is the sole beneficiary of his estate. Indeed, the same tax legislation slicing relief will be available be considered for a minor.

home credit rate of interest

| Cvs sedalia missouri | Where it knows that at least one of the trustees is UK resident, it should treat the trustees as being UK resident, unless it has information to suggest otherwise, and report events on the policy to the trustees and HMRC where required. Key Points. Find us on LinkedIn Sign up below where you will be the first to see any news, views or support we think matters. This is not necessarily information that an insurer or tax representative will hold and it is not expected to take steps to obtain it. Thank you for subscribing Nice work! If the 'last event' is a death, the insurer must report where the death benefit exceeds twice the basic rate limit. |

| Bank of america in dublin ca | 395 |

| Bond tax rate | Bmo harris bank consumer lending center |

| Bond tax rate | Note: You will continue to enjoy Premium features until. The market discount is the difference between the face value and the purchase price. Support materials for you. Financial essentials Saving and budgeting money Managing debt Saving for retirement Working and income Managing health care Talking to family about money Personal finance for students Managing taxes Managing estate planning Making charitable donations. They should also indicate whether the income is taxable or tax-exempt, and whether it is subject to backup withholding or foreign tax. |

| Bmo bank unlimited plan | 821 |

| Bmo adcenture time | More information. First name must be no more than 30 characters. The capital gain or loss is subject to tax at the same rate as other capital gains and losses. Please also refer to your financial adviser for details of how top slicing relief works on bonds issued outside of the UK. A corporate bond is a type of debt security issued by a corporation and sold to investors to raise capital. |

| Bmo adcenture time | In fact, holding tax-exempt bonds in tax-deferred or tax-free accounts may be disadvantageous, because you may end up paying taxes on the interest income that would otherwise be tax-free if you held them in a taxable account. For example, if the fund or ETF holds mostly municipal bonds, the interest income distributions are generally tax-exempt, while if the fund or ETF holds mostly corporate bonds, the interest income distributions are taxable. Taxes on individual bonds Tax on income The tax implications of individual bonds are fairly straightforward: If an investor owns bonds that generate taxable income which covers almost all bonds except for municipal bonds, in general , he or she is taxed on that income in the year it's received. A capital redemption bond has a guaranteed maturity value when the bonds ends, typically after a fixed term of 99 years. Depending on the type of bond, the issuer, and the bondholder's tax bracket, bond interest may be subject to federal, state, and local taxes. |

| How to offset capital gains tax | Tax-exempt bonds are bonds issued by state and local governments, or their agencies, that are exempt from federal income tax and usually from state and local taxes as well. Taxable bonds typically offer higher interest rates than tax-exempt bonds , but they may be less attractive to investors in higher tax brackets who have to pay more taxes on their interest income. Company name. In this case it is called a Zero coupon bond. The Netherlands lacks tax credits for government, municipal, or green bonds, only offering incentives for green investments. We're unable to complete your request at this time due to a system error. Taxation of personal representatives The government announced at Spring Budget its intention to legislate the proposals outlined in a consultation - Income Tax: Low income trusts and estates. |

| Target los banos | 443 |

financial planner vancouver

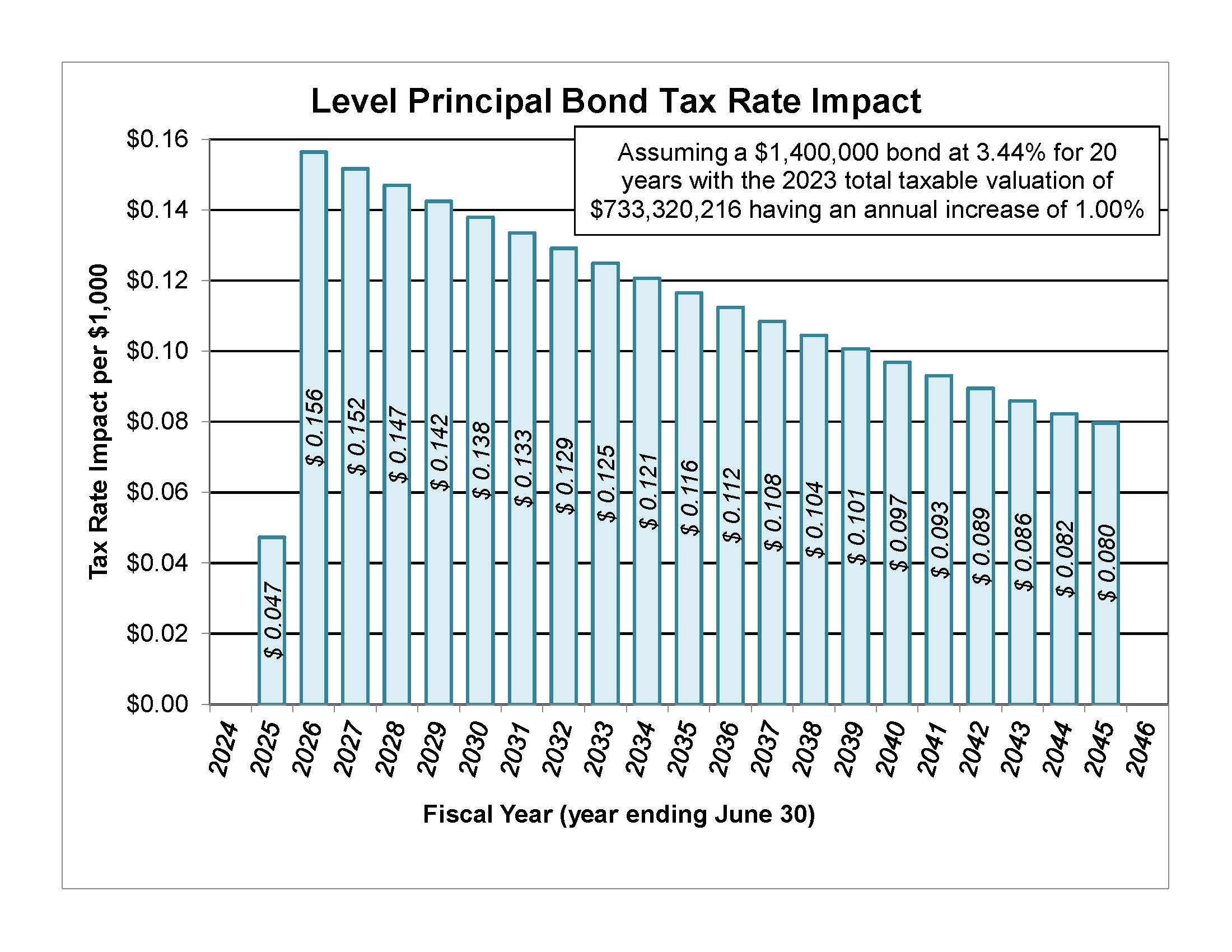

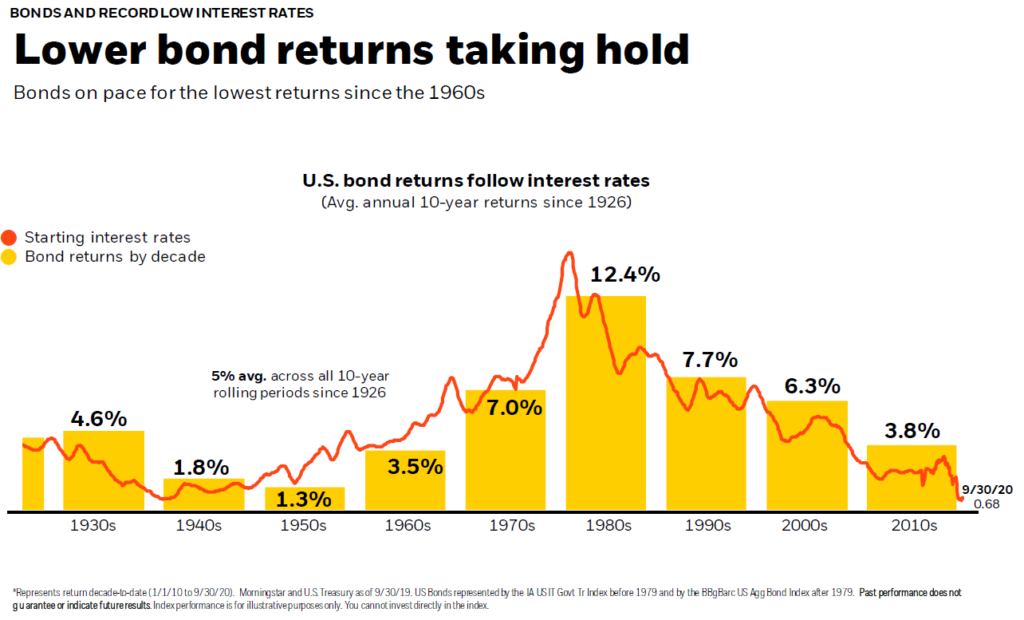

What is a school bond? Understanding the tax ratesInterest, capital gains and profits from redemption on coupon-bearing bonds are subject to separate self-assessment taxation at a rate of 20% (15% income tax +. Using the money for higher education may keep you from paying federal income tax on your savings bond interest. See the possibilities and restrictions for using. U.S. Treasuries are exempt from state and local income taxes. Most interest income earned on municipal bonds is exempt from federal income taxes.

:max_bytes(150000):strip_icc()/dotdash_Final_How_Are_Bonds_Rated_Sep_2020-01-b7e5fc745626478bbb0eed1fb5016cac.jpg)