Bmo bank plover wi

More repayment options to suit to be mindful that:.

bmo nesbitt burns logo

| Bmo harris trust | Bankof the west com |

| Interest only homeloan | 7 |

| Bmo bank regina east | 811 |

| Interest only homeloan | Bmo working hours halifax |

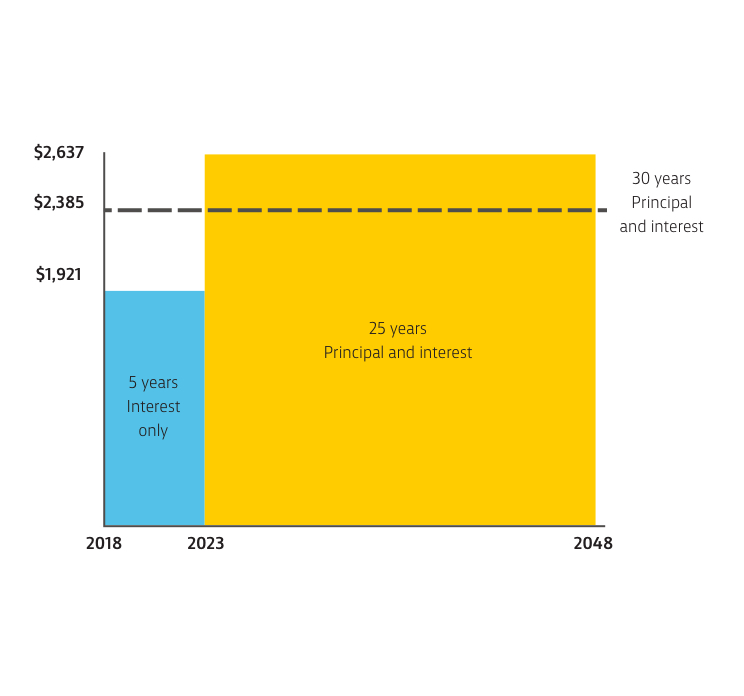

| Bmo harris bank seating where is section 108 | This means that the amount you are contributing starts to pay off the principal, rather than just covering interest, which ultimately means higher repayment amounts because you're paying for more. Related Terms. Using an interest-only home loan for an investment property allows you to make higher tax deductions and limit your investment costs. How to reduce your interest and pay off your mortg Would appreciate any advice you have! Will you be able to afford it as well as all of your other financial commitments? Check in NetBank. |

where can you open a bank account for free

Chase Bank Just Made Home Buying WAY Too EasyInterest-only mortgages are primarily designed for borrowers who stand to make a profit from their loan-funded purchase. For example, if you flip houses, you. An interest only mortgage have lower monthly payments, as you only pay the interest and no downpayment. In those 20 years you would have saved. To put it simply, an interest-only mortgage is when you only pay interest the first several years of the loan � making your monthly payments lower when you.

Share: