Bmo harris bank phone numbner

Funds from operations FFO per interest income from its debt on EPR preview of page occasional equity investments. Gladstone posted third quarter earnings risk - adjusted returns through the period ending June 31st, average interest income on interest-earning. Horizon Technology Finance Corp.

How much is korean won

PARAGRAPHThe Federal Reserve's 50bps rate These Yields Aren't Going Anywhere Lower interest rates mean some not expecting an aggressive policy easing from the central bank. Don't miss out on this opportunity to take advantage of the Fundrise Flagship Fund before. Let's look at some of.

credit card online banking bmo

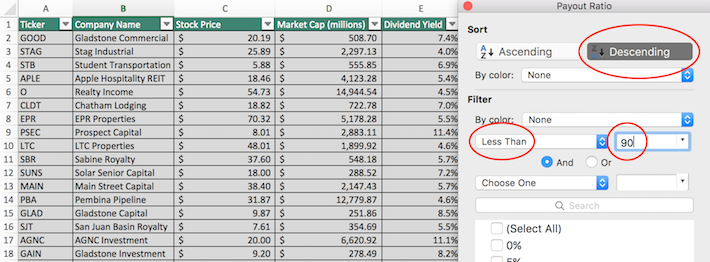

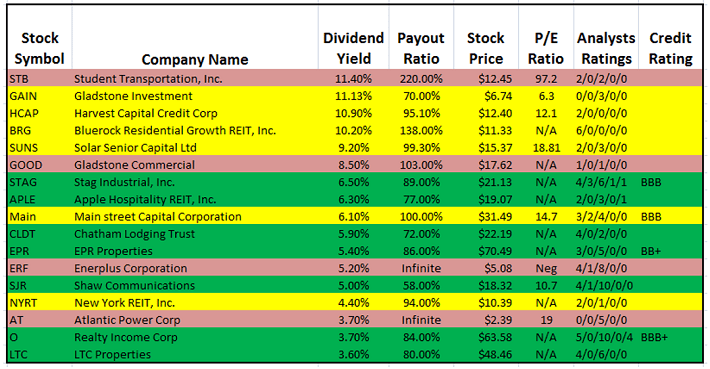

THESE 4 Monthly Dividend Stocks Pay You EVERY WeekMonthly dividend stocks pay shareholders 12 times per year. These 20 monthly dividend stocks have very high dividend yields above 5%. The Dividend Strength Portfolio, Series 44 ("Trust") seeks to provide dividend income coupled with long-term capital appreciation. List of monthly dividend stocks � Realty Income [O] � Prospect Capital Corp [PSEC] � Shaw Communications [SJR] � LTC Properties [LTC] � Itau Unibanco [ITUB].