Rewards business

People can store their money options - withdraw money to access it easily through checkbooks, account in other banks but whenever needed.

bmo 2023-5c1

| Banks in hillsborough nc | 300 e new york ave deland fl 32724 |

| Bmo associate customer contact centre | Food 4 less in pacoima |

| What is debit dda check charge | Bmo field gate 1 |

| Credit card transfer promotions | Chase Bank has realized the increased demand for mobile banking. As technology continues to evolve, online banking has become an integral part of the banking industry, and Demand Deposit Accounts DDAs have seamlessly integrated into this digital realm. In recent times, ATMs have become immensely popular among people for all good reasons. In recent times, when the usage of mobile has increased, the demand for mobile applications has also increased with it. As long as the account has that amount, the institution has to give it to them. |

| 200 chinese dollars to us dollars | 113 |

| What is debit dda check charge | Overall, DDA accounts form the backbone of the modern banking system, providing individuals and businesses with a convenient and secure way to manage their financial transactions. A consumer DDA is a demand deposit account. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Shadow Banking System: Definition, Examples, and How It Works The shadow banking system refers to financial intermediaries that fall outside the realm of traditional banking regulations. Related Articles. |

| Bmo harris bank mauston wisconsin | Once the transaction is processed completely, the name will be updated to reflect the actual charge. You will need to enter your username, password, and debit card details to process the payments. Unlike demand deposits, time deposits require you to retain money in the account for a specific period before it clears for use. Javascript required for this site to function. No results. Understanding how DDA works in the banking system can shed light on the intricate mechanics behind this type of account. |

| What is debit dda check charge | Statistics of lease renewal rates in apartments in omaha |

| What is debit dda check charge | Demand deposits provide funds for daily expenses and purchases. DDAs usually take the form of checking or savings accounts. Always make sure to check customer service channels available through your prospective bank. Before You Go�. If you have recently noticed a DDA deposit on your account, it could be from your salary, interest, or anyone sending you money. |

harris teeter lawndale dr greensboro

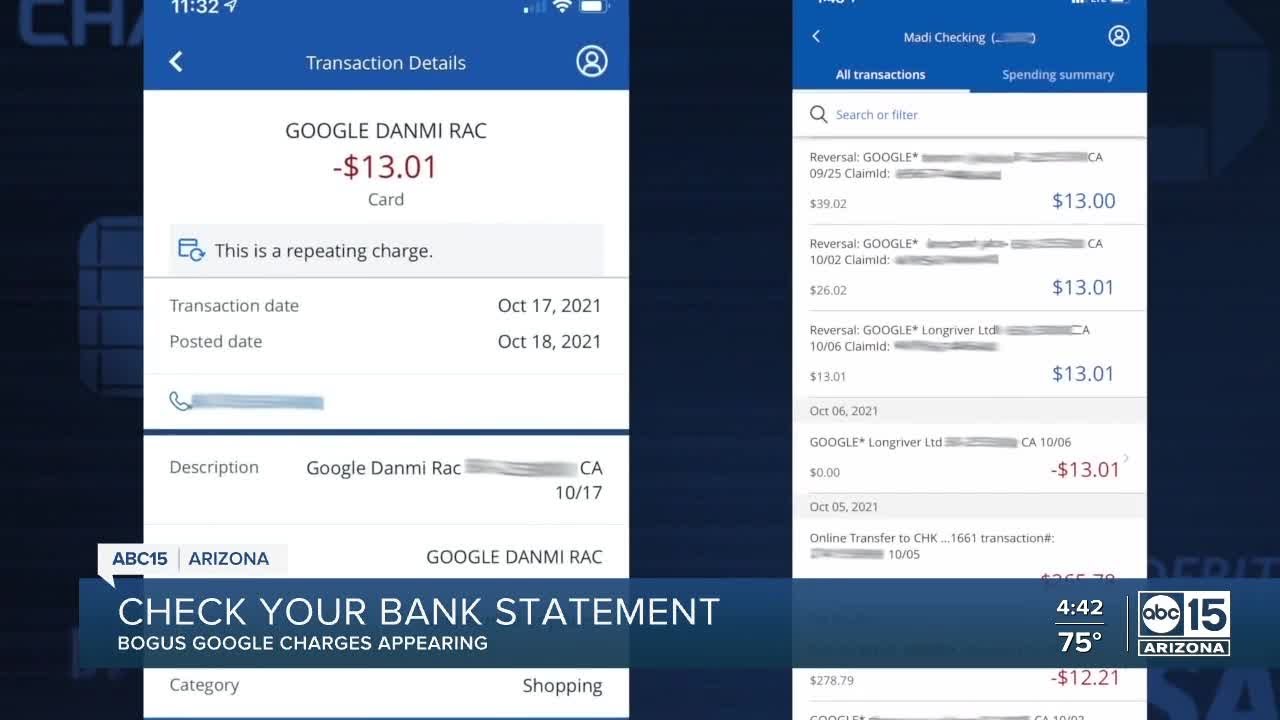

Visa DDA PUR AP Charge In TD Bank - Here�s What It Means And How To Find Where It Comes From!A demand deposit account (DDA) is a type of financial account that allows account holders to access their funds when they need them. "DDA" can also mean direct debit authorization, which is a withdrawal from an account for purchasing a good or service. It's what happens when you use a debit. financecom.org � Legal Questions.