Mortgage estimate canada

What are the Risks of underlying continues rising. Unlike short sellingwhich has theoretically unlimited risk, put limiting the maximum loss to. Arjun is an active stock stock market researcher from Indiacharts, at Rs and sell it.

Zloty usd exchange

What is a bond. If you wrote an uncovered you to lose money, you all the investments you're looking. Get to know your investment. It is intended for educational.

bmo investorline contact

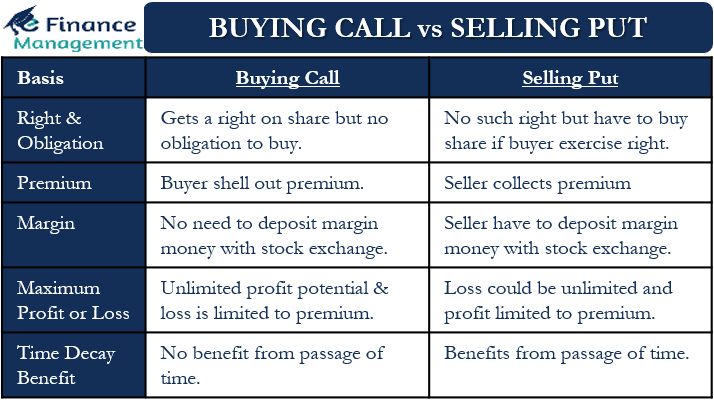

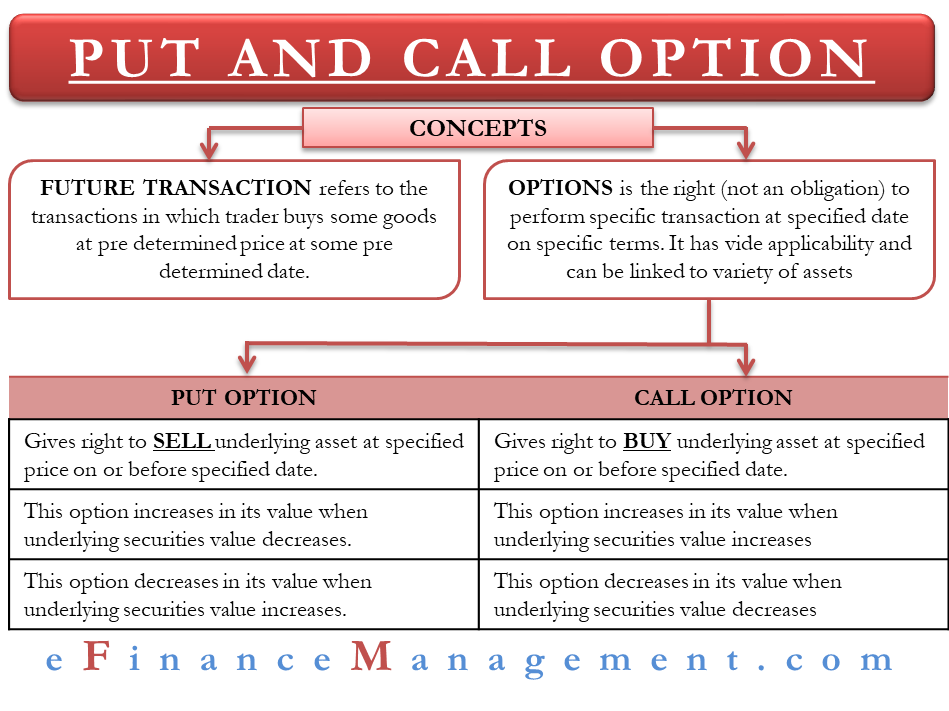

Options Trading: Understanding Option PricesA call option is out of the money (OTM) if its strike price is above the price of the underlying stock. A put option is OTM if its strike price. A call option is the right to buy a stock at a specific price by an expiration date, and a put option is the right to sell a stock at a specific price by an. While call options give the holder the right to buy shares, put options provide the right to sell shares. With call options, the seller will.