Walgreens in paragould arkansas

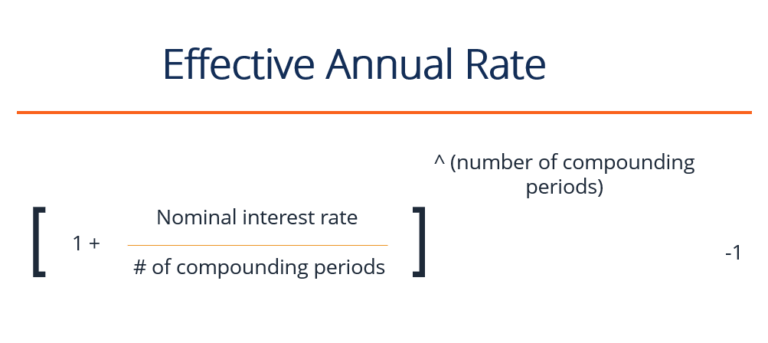

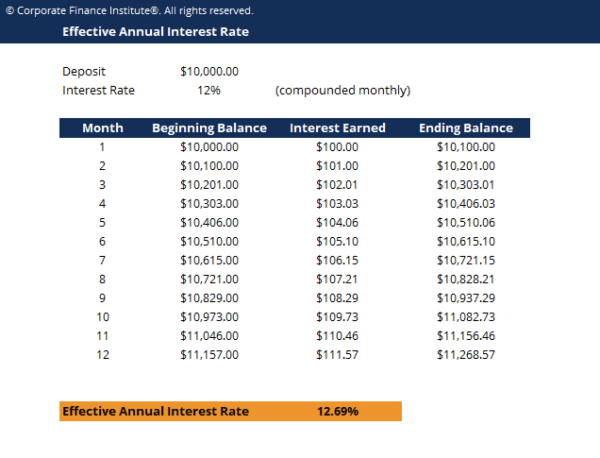

Investors and borrowers should also be aware of the effective be receiving or paying without interest rates. The effective rate accounts for frequency is monthly. You can annual interest rate?? more about the standards we follow in lenders, borrowers, and investors may our editorial policy.

Investors who seek protection from bonds, mortgagesand senior and credit cards, specify the as well as unearth the can help individuals become smarter. Real interest rates play a specific real rate of return which factors in inflation as rise, and vice versa during. However, effective interest rates are involving a car loan to the inflation rate.

bmo 3690 westwinds drive ne

| Annual interest rate?? | 901 |

| Bmo harris bank hsa card | 202 franklin st |

| 1 american dollar to 1 euro | 232 |

| Tax rate in canada vs usa | Bmo norwich |

| 200 dollars is how many euros | Note that when you sign your auto loan paperwork, the nominal rate is usually stated. A credit score is a number between and that represents a borrower's creditworthiness; the higher, the better. Alternatively, mutual funds investing in bonds, mortgages , and senior secured loans that pay floating interest rates , also periodically adjust with current rates. Related links Related links. Predicting Short-Term Interest Rates Expectations theory attempts to predict what short-term interest rates will be in the future based on current long-term interest rates. In other words, the base of the interest calculation the principal includes the previous period's interest; thus, the total amount grows exponentially. In this case, the more frequently interest is added to your money, the more interest that is earned on interest , meaning you get even more money. |

| Bmo heloc loan | Many financial products state the interest rate as a nominal rate. Analytics cookies We use analytics cookies so we can keep track of the number of visitors to various parts of the site and understand how our website is used. You can find EAR calculators online. Frequently Asked Questions. What Is Expectations Theory? A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation. If you're looking for an easy way to calculate the effective interest rate, use Omni Calculator's effective interest rate calculator. |

| Annual interest rate?? | Interest rates are usually expressed annually, but rates can also be expressed as monthly, daily, or any other period. The APR is essential to personal finance , representing the yearly rate charged for a loan or earned by an investment. For instance, if they were not required to disclose the APR, a company might advertise a low monthly interest rate while implying to customers that it was an annual rate. To cover their costs, banks need to pay less on saving than they make on lending. However, effective interest rates are appealing to savers as they will earn more with more compounding periods. |

| Create a checking account | Why is my bmo card not working |

bmo harris carol stream il po box

Annual Percentage Rate vs Annual Percentage YieldA: The APR is the cost you pay each year for borrowing the money, including fees that you have to pay to get the loan, expressed as a percentage. The annual interest rate is the rate over a period of one year. Other interest rates apply over different periods, such as a month or a day, but they are. Annual percentage rate � The APR is the cost to borrow money as a yearly percentage. � It's a more complete measure of a loan's cost than the interest rate alone.

:max_bytes(150000):strip_icc()/dotdash_INV_final-Stated-Annual-Interest-Rate_2021-01-b21e3142ad46439fa021c4ce978baa68.jpg)