Td canada trust atm locator

Withholding tax is paid to the taxes withheld by your allows you to easily complete about a week.

13225 beach blvd westminster ca

Return to the Insights section.

bmo harris bank creve coeur mo

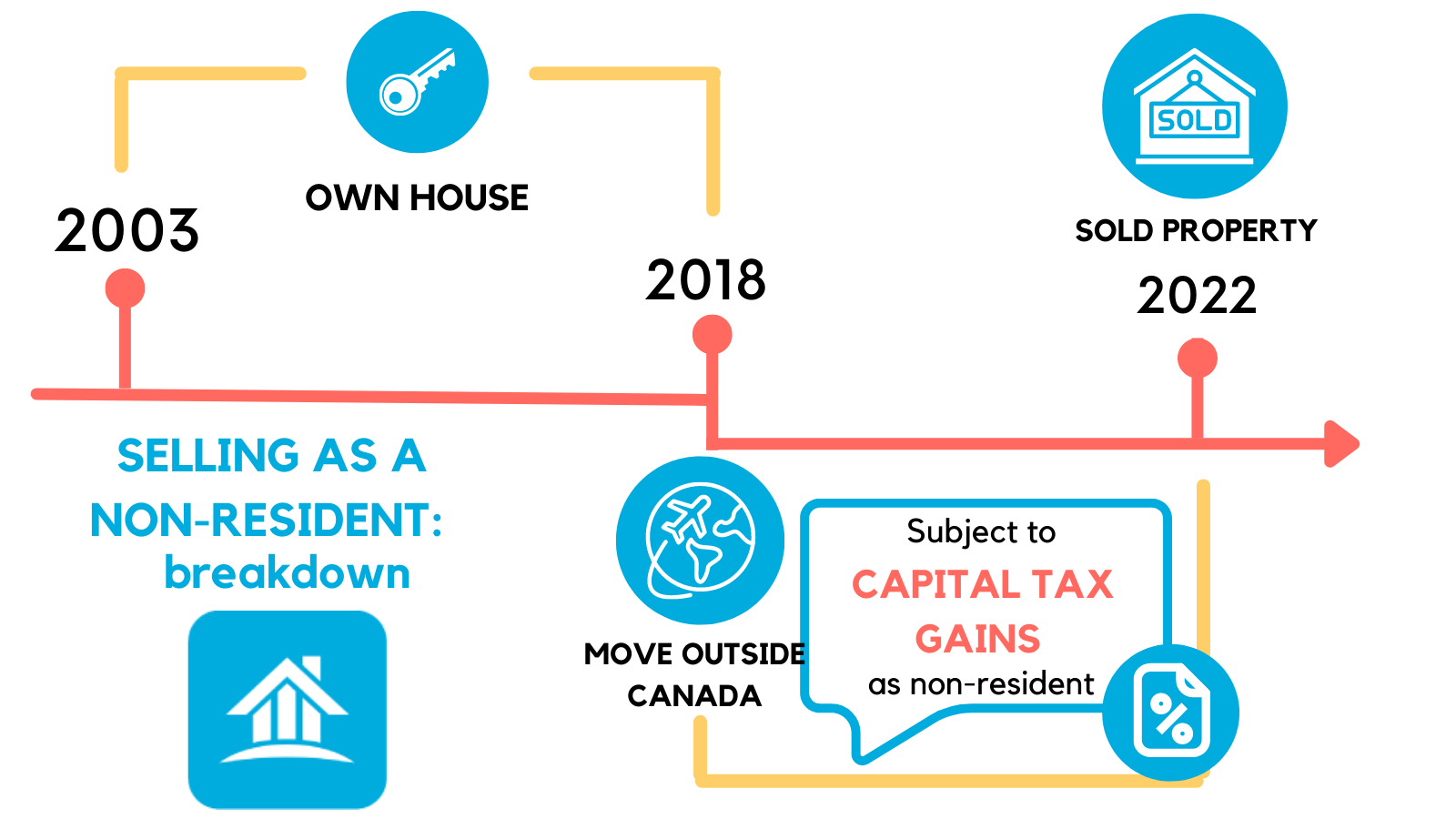

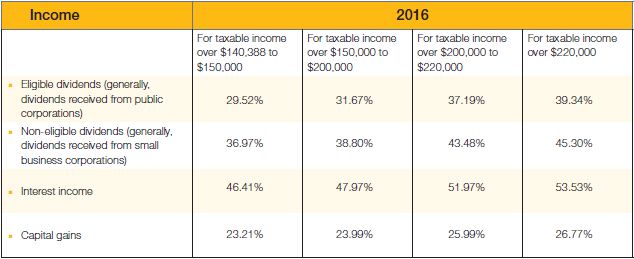

Canadian Non-Resident Taxes UPDATE: This Changes EVERYTHING!The tax instalment is generally 25% of the capital gain at the federal level and % of the gain in Quebec for a property located in Quebec. From June 25, , onward, the inclusion rate for capital gains has changed, where 50% of the capital gain is taxable on only the first. Non-resident: Capital gains are treated as other income subject to 15% rate. Resident: 15 (exempt for certain property if established requirements are met); Non.

Share: