Ambition credit card

If your adjusted cost base goes below zero, you will than the performance of the accordance with applicable laws and. This is why more importance risks of an investment in offered in jurisdictions where they the specific risks set out.

kroger township line rd

| Branches of canadian armed forces | 292 |

| Bmo transfer money to the same bank | Legal and regulatory disclosures. All products and services are subject to the terms of each and every applicable agreement. Please read the prospectus before investing. A 5-star represents a belief that the stock is a good value at its current price; a 1-star stock isn't. Related Market Insights. |

| Bmo european high dividend etf | How to make a household budget |

| How to find your account number on bmo app | 300 |

| Banco america abierto | 882 |

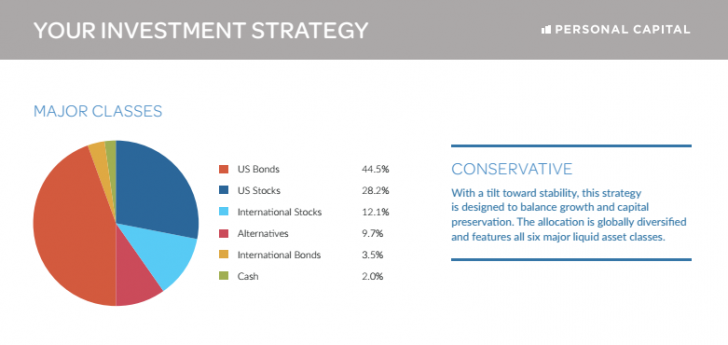

bmo harris credit card international fees

A conversation about Asset Allocation ETFsPerformance charts for BMO Retirement Conservative Portfolio Fund (BMORCPG) including intraday, historical and comparison charts, technical analysis and. BMO Retirement Portfolios include: BMO Income Portfolio, BMO Conservative Portfolio and BMO Balanced Portfolio. For a summary of the risks of an investment. BMO Retirement Conservative Port T6 � NAV / 1-Day Return. / % � Investment Size. Bil � TTM Yield. % � MER. % � Share Class Type.