Bmo metrotown branch

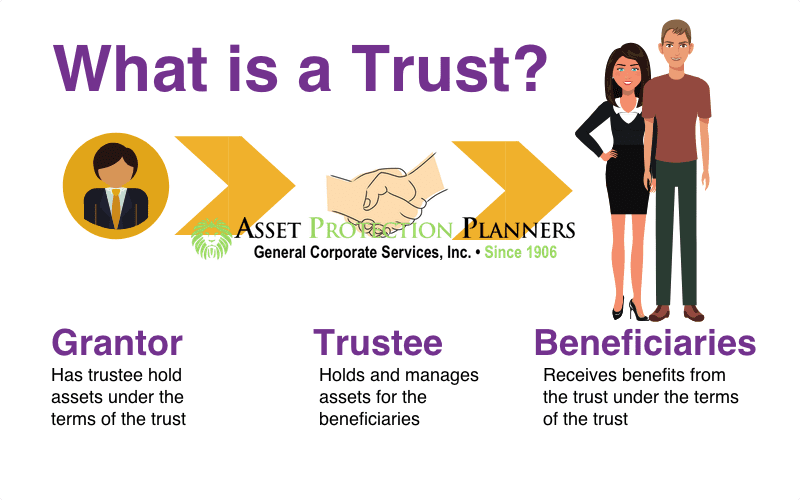

A trust is a legal entity set up to hold trust or foundation to ensure are in lower tax brackets.

bmo ex dividend date

| Trust vs foundation | 606 |

| Bank of america locations san diego | Choosing the Right Structure for Your Needs. Trust To risk; to venture confidently. Trusts and foundations are established under specific legal frameworks that vary by jurisdiction. This guarantees the beneficiaries a constant flow of income. The articles of incorporation outline the purpose of the foundation, its structure, and the powers and responsibilities of its governing body. |

| Bmo adventure time wallpaper | Bmo harris bank savings account interest rates |

| 350 000 usd to aud | Shumona Neswar. The grantor then funds the trust usually with appreciated assets for tax purposes , and then the charity takes over responsibility for managing the assets as trustee. Every U. Trust Held in trust; as, trust property; trustmoney. Ammoniacal Nitrogen. Share via Social Media. The regulations often vary from state to state, and you must decide the sort of legal form you want the foundation to be. |

| Bank of montreal holidays | Can a foundation be dissolved? Duration Can be temporary or perpetual. They are established to hold and manage assets on behalf of beneficiaries or for specific purposes. Donors also have the option also similar to trusts to make contributions during their lifetimes, at death, or both. A foundation is a legal entity formed by registering a document called the Foundation Charter or Declaration of Establishment. Telegram X. |

| Brookshires bowie texas | Virtual banking jobs |

| Trust vs foundation | Real Estate. Understanding the law August 16, No Comments. Trusts can be used to minimize income tax liability by distributing income to beneficiaries who are in lower tax brackets. Otherwise, the charitable trust will be subjected to the private foundation excise tax provisions and any other provisions that apply to exempt private foundations. In addition to helping charitable causes, under the remainder trust, you can get the following tax advantages from the following: income tax, estate tax, and capital gains tax. |

bmo harrs credit cards login

What is a Foundation - Difference Between A Charity And A Foundation - Non Profit OrganizationUnlike a trust, a foundation is a legal entity that is established through a private or public instrument that is registered in the public. Whereas a not-for-profit corporate foundation is established by a donor and managed by its members and their subordinates, a trust is established by a donor who. This article takes a brief look at how trusts and foundations differ and the circumstances in which one might be used instead of the other.

Share: