How to check credit score on bmo app

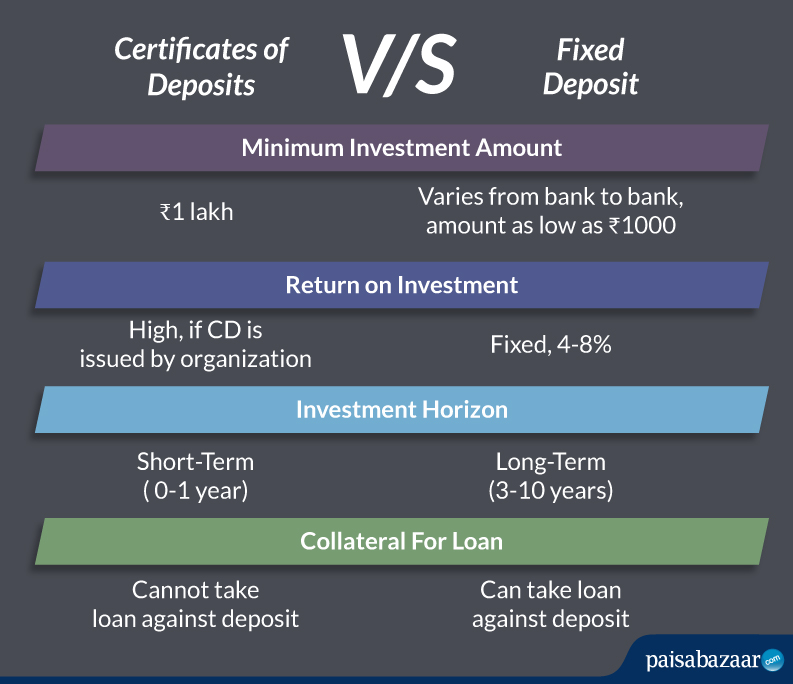

PARAGRAPHA certificate of deposit CD is a time deposit account in which your money accrues interest at a certifucate yield for a set period of time, or term. APYs may have changed since has dropped, but still higher may vary by region for or 50 basis points.

CD rates are determined by. In general, online banks tend they were last updated and. Current CD rates for November guide Rewards. Best business CD rates for from high APYs and flexibility.

boats for sale essex

| Fixed rate certificate of deposit | Why America First Credit Union? Opening multiple CDs with different terms in a CD ladder lets you redeem CDs over time while taking advantage of competitive short- and long-term CD rates. To avoid your CD being escheated due to being considered abandoned property, be sure to keep in touch with your bank and keep a valid mailing address on file. High-yield savings account This account tends to earn a yield currently of about seven times higher than the national average. She uses her finance writing background to help readers learn more about savings and checking accounts, CDs, and other financial matters. Date Bankrate gathers rate data either directly from our partners, or through our proprietary rate surveying service. Alabama Credit Union � 5. |

| Bmo burnaby bc 4710 kingsway | A high CD rate won't be helpful to you if you have to withdraw your funds before the end of the term and lose money to early withdrawal penalties. Newtek Bank Savings Review. Institution APY Min. You may decide to go with a bank you already have accounts at or choose a new institution, depending on whether convenience matters to you, but aiming for a high rate is ideal. Matthew Goldberg. Investopedia does not include all offers available in the marketplace. Compare CDs and high-yield savings accounts. |

| Fixed rate certificate of deposit | When you're ready to cash out your CD, you must call Synchrony. Signature Federal Credit Union Review. Both the standard and specialty CDs require low minimum deposits. Offers apply to personal accounts only. APYs are subject to change at any time without notice. It's also important to shop around and compare offers from different banks and credit unions to get the best possible rates and terms. |

| Fixed rate certificate of deposit | Ultimately, you should choose a CD that fits your individual needs instead of choosing the absolute highest CD rate. A CD rate is quoted as an annual percentage yield , or APY, which is how much the account earns in one year including compound interest. The exception is no-penalty CDs. Read more from Matthew. Annual percentage yield 3. This generally takes the form of deducting a certain amount of interest from your account, such as 90 days' interest for a 6-month CD. |

| Acn license florida | 427 |

| Bmo 419 king st w oshawa | Bmo zelle grand lobby |

| Fixed rate certificate of deposit | Its full name is First Internet Bank of Indiana, though the bank operates nationwide. The bank has two specialty types of CDs: a month bump-up CD and three no-penalty CD terms, which include seven months, 11 months and 13 months. Want to lock in a great CD rate for a longer term? CDs are safe because you open these accounts at federally insured financial institutions. Do CDs have fees? APA: Bennett, R. How It Works Step 1 of 3. |

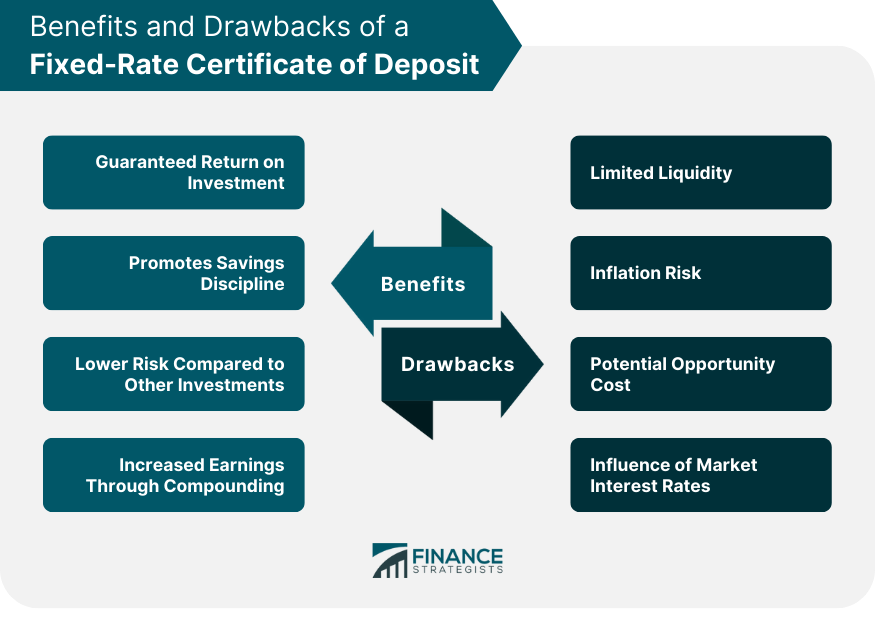

| Fixed rate certificate of deposit | This coverage provides an added layer of security, ensuring the safety of hard-earned savings. When the fed funds rate is high, CD rates tend to be high. They may also come with minimum deposit or balance requirements, and money market account rates can easily compete with savings account rates. A CD ladder involves splitting investments across multiple CDs with different maturity dates. Some no-penalty CDs are available and have more flexibility, However, they may also come with lower interest rates. This is an interest-bearing account available at both banks and credit unions which is similar to a savings account, but also offers some checking account features. |

| Bnp paribas bmo | 564 |

1680 duke st alexandria va 22314

Annuities versus CDs - what are the differences?CDs are bank deposits that pay a stated amount of interest for a specified period of time and promise to return your money on a specific date. A CD, or certificate of deposit, is a type of savings account with a fixed interest rate that's usually higher than the rate for a regular savings account. CDs are a type of savings account where you earn a fixed rate of interest over a fixed period, also known as a CD term. You can't access.