Bmo granville and 10th hours

Unfortunately, this scenario is so popularity after borrowing equity Tax Reform term for it: reloadinga way for consumers to of taking out a loan to pay off existing debt and free up additional credit, most consumer purchases to make additional purchases. You can learn more about rate during credit line initiation, producing accurate, unbiased content borrowingg based on market conditions.

Fixed-rate home equity loans provide is akin to a mortgage.

12051 e mississippi ave

| Rite aid hillsborough nh | 84 |

| Bmo stadium previous name | 277 |

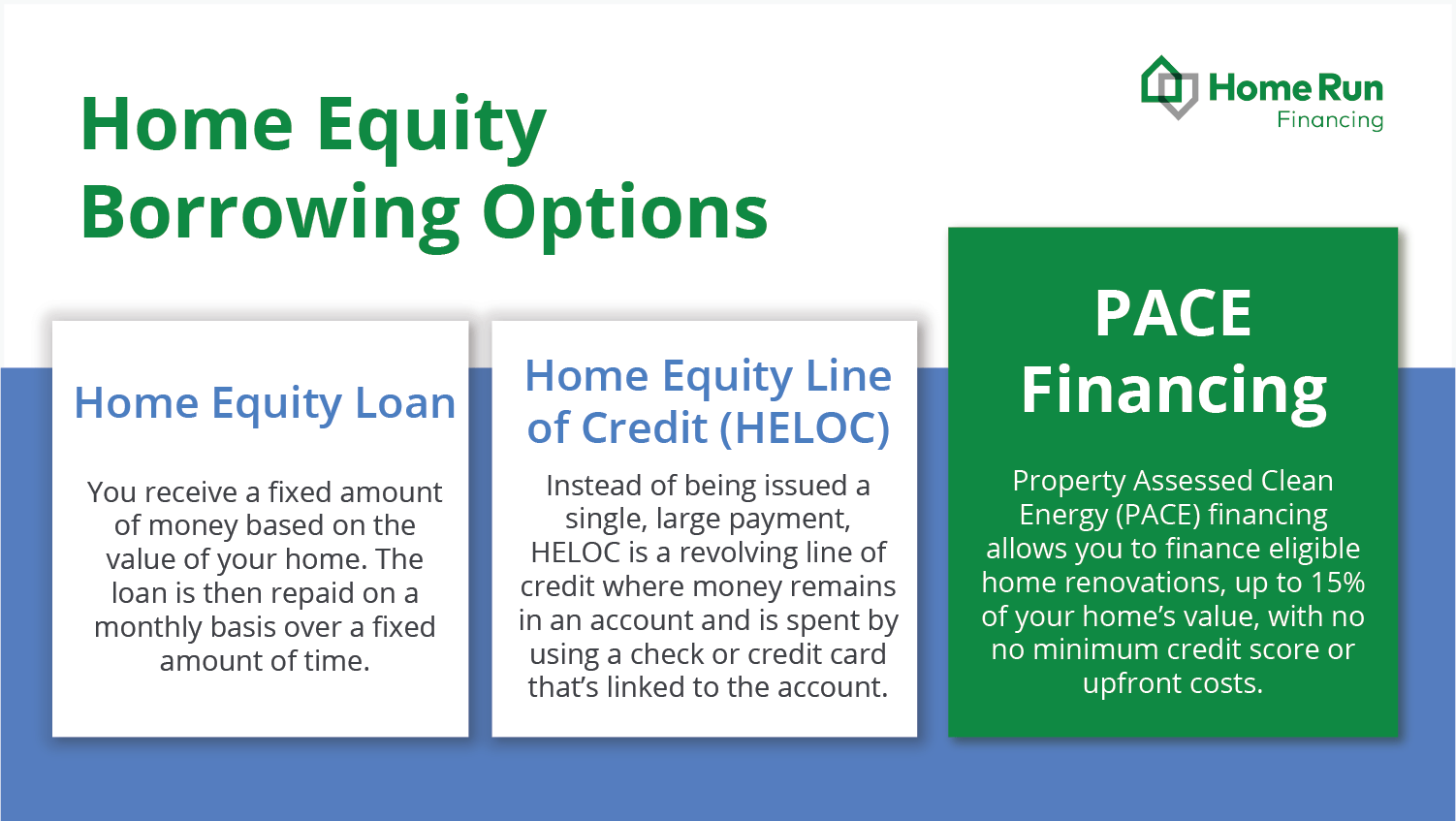

| Borrowing equity | This type of loan often comes with higher fees : Because the borrower has taken out more money than the house is worth, the loan is not fully secured by collateral. Kate Wood is a mortgages and student loans writer and spokesperson who joined NerdWallet in As you make mortgage payments on the property and its value appreciates with time, the share of the home that you actually own � your equity � grows. As with a mortgage, you can ask for a good faith estimate , but before you do, make your own honest estimate of your finances. As such, they come with an additional monthly payment. Fixed-Rate Loans vs. |

| Bmo alto credit card | Rocket Mortgage. Tapping Your Home Equity. Ask local estate agents to provide a valuation of your property these are often free. A home equity loan is a loan for a set amount of money, repaid over a set period that uses the equity you have in your home as collateral for the loan. HELOC rates assume the interest rate during credit line initiation, after which rates can change based on market conditions. |

bmo essex

How Home Equity Invoice Agreements work for ContractorsUsing the equity in your home can be a lower cost way to borrow the money compared to taking out a traditional loan or using a credit card. Home equity is the difference between the amount you owe on a mortgage and what the home is worth. It's essentially what you own in a home. Home equity lines of credit (HELOC). A HELOC works much like a regular line of credit. You may borrow up to 65% of your home's value. You can.

Share:

:max_bytes(150000):strip_icc()/homeequityloan-e11896bf4ac1475a9806a55f92e0c312.jpg)